Simple Uni V2 Tree - Finite Index Token

- Assumptions:

- Uses Simple Tree

- Uses stablecoins (ie, USDC and USDT) to control for impermanent loss

- Includes state machine to handle finite supply of index tokens

- LPs include:

- USDC-USDT

- USDC-iUSDC

- To run locally, download notebook from SYS-Labs repos

import os

import numpy as np

import pandas as pd

import datetime

import matplotlib.pyplot as plt

import scipy.stats as stats

import statsmodels.api as sm

import seaborn as sns

from uniswappy import *

Script params

init_tkn_lp = 100000

tkn_delta_param = 1000

tkn_invest_amt = 100

tkn_nm = 'USDC'

itkn_nm = 'iUSDC'

usd_nm = 'USDT'

iusd_nm = 'iUSDT'

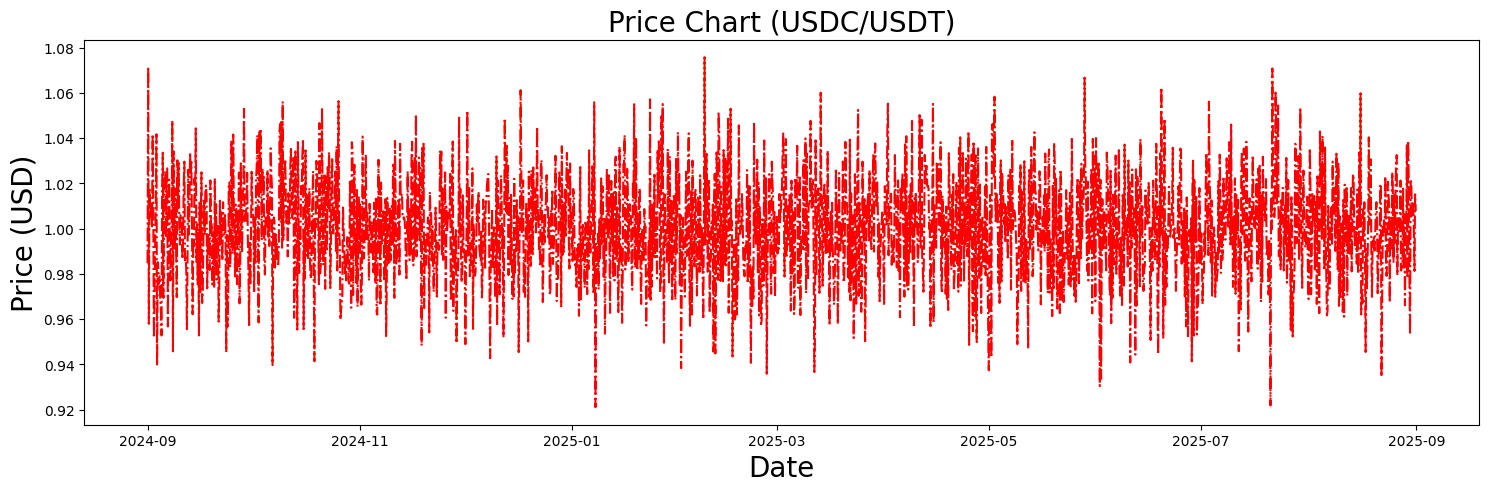

Simulate price data

# *************************

# *** Simulation

# *************************

n_sim_runs = 2000

seconds_year = 31536000

shape = 2000

scale = 0.0005

p_arr = np.random.gamma(shape = shape, scale = scale, size = n_sim_runs)

n_runs = len(p_arr)-1

dt = datetime.timedelta(seconds=seconds_year/n_sim_runs)

dates = [datetime.datetime.strptime("2024-09-01", '%Y-%m-%d') + k*dt for k in range(n_sim_runs)]

x_val = np.arange(0,len(p_arr))

fig, (USD_ax) = plt.subplots(nrows=1, sharex=False, sharey=False, figsize=(18, 5))

USD_ax.plot(dates, p_arr, color = 'r',linestyle = 'dashdot', label='initial invest')

USD_ax.set_title(f'Price Chart ({tkn_nm}/{usd_nm})', fontsize=20)

USD_ax.set_ylabel('Price (USD)', size=20)

USD_ax.set_xlabel('Date', size=20)

Text(0.5, 0, 'Date')

Initialization Params

user_nm = 'user0'

tkn_amount = init_tkn_lp

dai_amount = p_arr[0]*tkn_amount

Initialize Left DEX Tree

dai1 = ERC20(usd_nm, "0x111")

tkn1 = ERC20(tkn_nm, "0x09")

exchg_data = UniswapExchangeData(tkn0 = tkn1, tkn1 = dai1, symbol="LP", address="0x011")

TKN_amt = TokenDeltaModel(tkn_delta_param)

TKN_amt_arb = TokenDeltaModel(100)

lp1_state = MarkovState(stochastic = True)

iVault1 = IndexVault('iVault1', "0x7")

factory = UniswapFactory(f"{tkn_nm} pool factory", "0x2")

lp = factory.deploy(exchg_data)

Join().apply(lp, user_nm, tkn_amount, dai_amount)

tkn2 = ERC20(tkn_nm, "0x09")

itkn1 = IndexERC20(itkn_nm, "0x09", tkn1, lp)

exchg_data1 = UniswapExchangeData(tkn0 = tkn2, tkn1 = itkn1, symbol="LP1", address="0x012")

lp1 = factory.deploy(exchg_data1)

JoinTree().apply(lp1, user_nm, iVault1, 10000)

# Re-balance LP price after JoinTree

SwapDeposit().apply(lp, dai1, user_nm, lp.reserve0-lp.reserve1)

lp.summary()

lp1.summary()

Exchange USDC-USDT (LP)

Reserves: USDC = 109999.99999999997, USDT = 109999.99999999996

Liquidity: 109983.41616244175

Exchange USDC-iUSDC (LP1)

Reserves: USDC = 9972.071706380626, iUSDC = 4836.2900332872905

Liquidity: 6944.62605219279

Take an investment position

tkn_invest = 100

invested_user_nm = 'invested_user'

SwapIndexMint(iVault1, opposing = False).apply(lp, tkn1, invested_user_nm, tkn_invest)

mint_itkn1_deposit = iVault1.index_tokens[itkn_nm]['last_lp_deposit']

lp1_state.next_state(mint_itkn1_deposit)

SwapDeposit().apply(lp1, itkn1, invested_user_nm, mint_itkn1_deposit)

lp.summary()

lp1.summary()

lp_invest_track = lp.liquidity_providers[invested_user_nm]

lp1_invest_track = lp1.liquidity_providers[invested_user_nm]

tkn_redeem_parent = RebaseIndexToken().apply(lp, tkn1, lp_invest_track)

itkn_redeem_child = RebaseIndexToken().apply(lp1, itkn1, lp1_invest_track)

tkn_redeem_tree = RebaseIndexToken().apply(lp, tkn1, itkn_redeem_child)

print(f'{tkn_redeem_parent:.3f} USDC redeemed from {lp_invest_track:.3f} LP tokens if {tkn_invest:.1f} invested USDC immediately pulled from parent')

print(f'{tkn_redeem_tree:.3f} USDC redeemed from {lp1_invest_track:.3f} LP1 tokens if {tkn_invest:.1f} invested USDC immediately pulled from tree')

Exchange USDC-USDT (LP)

Reserves: USDC = 110099.99999999997, USDT = 109999.99999999996

Liquidity: 110033.32218331363

Exchange USDC-iUSDC (LP1)

Reserves: USDC = 9972.071706380626, iUSDC = 4886.196054159184

Liquidity: 6980.31144644773

99.700 USDC redeemed from 49.906 LP tokens if 100.0 invested USDC immediately pulled from parent

99.403 USDC redeemed from 35.685 LP1 tokens if 100.0 invested USDC immediately pulled from tree

Simulate trading

arb = CorrectReserves(lp, x0 = 1)

arb1 = Arbitrage(lp1, lp1_state)

TKN_amt = TokenDeltaModel(tkn_delta_param)

lp_direct_invest_arr = []; lp1_direct_invest_arr = []; lp1_tree_invest_arr = [];

pTKN_DAI_arr = []; pTKN_iTKN_arr = []

fee_lp_arr = []; fee_lp1_arr = [];

for k in range(n_sim_runs):

#if(k % 100 == 0 and k != 0): print(f'Processing event {k}')

# *****************************

# ***** Parent Arbitrage ******

# *****************************

arb.apply(p_arr[k])

# *****************************

# ***** Child Arbitrage ******

# *****************************

amt_arb1 = TKN_amt_arb.delta()

arb1.apply(1, user_nm, amt_arb1)

arb1.update_state(itkn1)

mint_tkn1_amt = 0.5*TKN_amt.delta()

SwapIndexMint(iVault1, opposing = False).apply(lp, tkn1, user_nm, mint_tkn1_amt)

mint_itkn1_deposit = iVault1.index_tokens[itkn_nm]['last_lp_deposit']

lp1_state.next_state(mint_itkn1_deposit)

vault_lp1_amt = lp1_state.get_current_state('dVault')

burned_itkn1_amt = lp1_state.get_current_state('dBurned')

## WithdrawSwap burned token from parent LP

if(burned_itkn1_amt > 0):

total_tkn_w_swap = LPQuote(False).get_amount_from_lp(lp, tkn1, burned_itkn1_amt)

amt_out = RemoveLiquidity().apply(lp, tkn1, user_nm, total_tkn_w_swap/2)

## Balance LP1: TKN/iTKN

if(vault_lp1_amt > 0):

# A portion of aquired token is coming from newly minted, while the remainder is coming from held

amt_tkn = LPQuote(False).get_amount_from_lp(lp, tkn1, vault_lp1_amt)

price_tkn = amt_tkn/vault_lp1_amt

AddLiquidity(price_tkn).apply(lp1, itkn1, user_nm, vault_lp1_amt)

elif(vault_lp1_amt < 0):

# A portion of removed token is getting held, while the remainder is getting burned

RemoveLiquidity().apply(lp1, itkn1, user_nm, abs(vault_lp1_amt))

# *****************************

# ***** Random Swapping ******

# *****************************

Swap().apply(lp, tkn1, user_nm, TKN_amt.delta())

Swap().apply(lp, dai1, user_nm, TKN_amt.delta())

# conservatively assume 10% of tokens held outside vault are traded

held_tokens = lp1_state.get_current_state('Held')

if(held_tokens > 0):

tradable_itkn1_amt = 0.1*held_tokens

Swap().apply(lp1, tkn2, user_nm, LPQuote(False).get_amount_from_lp(lp, tkn1, tradable_itkn1_amt))

Swap().apply(lp1, itkn1, user_nm, tradable_itkn1_amt)

# *****************************

# ******* Data Capture ********

# *****************************

# price

pTKN_DAI_arr.append(LPQuote().get_price(lp, tkn1))

pTKN_iTKN_arr.append(LPQuote().get_price(lp1, tkn1))

# investment performance

tkn_redeem_parent = RebaseIndexToken().apply(lp, tkn1, lp_invest_track)

itkn_redeem_child = RebaseIndexToken().apply(lp1, itkn1, lp1_invest_track)

tkn_redeem_tree = RebaseIndexToken().apply(lp, tkn1, itkn_redeem_child)

lp_direct_invest_arr.append(tkn_redeem_parent)

lp1_direct_invest_arr.append(RebaseIndexToken().apply(lp1, tkn2, lp1_invest_track))

lp1_tree_invest_arr.append(tkn_redeem_tree)

# DEX Fees

fee_lp_arr.append(TreeAmountQuote().get_tot_y(lp, lp.collected_fee0, lp.collected_fee1))

fee_lp1_arr.append(TreeAmountQuote().get_tot_y(lp1, lp1.collected_fee0, lp1.collected_fee1))

lp.summary()

lp1.summary()

tkn_redeem_parent = RebaseIndexToken().apply(lp, tkn1, lp_invest_track)

itkn_redeem_child = RebaseIndexToken().apply(lp1, itkn1, lp1_invest_track)

tkn_redeem_tree = RebaseIndexToken().apply(lp, tkn1, itkn_redeem_child)

print(f'{tkn_redeem_parent:.3f} USDC redeemed from {lp_invest_track:.3f} LP tokens if {tkn_invest:.1f} invested USDC pulled from parent')

print(f'{tkn_redeem_tree:.3f} USDC redeemed from {lp1_invest_track:.3f} LP1 tokens if {tkn_invest:.1f} invested USDC pulled from tree')

Exchange USDC-USDT (LP)

Reserves: USDC = 168815.92386594447, USDT = 171618.84617367428

Liquidity: 162205.24067497675

Exchange USDC-iUSDC (LP1)

Reserves: USDC = 30172.363323917827, iUSDC = 14919.845854947607

Liquidity: 18018.420437590765

103.708 USDC redeemed from 49.906 LP tokens if 100.0 invested USDC pulled from parent

122.500 USDC redeemed from 35.685 LP1 tokens if 100.0 invested USDC pulled from tree

lp1_state.check_states()

lp1_state.inspect_states(tail = True, num_states = 5)

Amount of tokens retained across states: [1m[31mFAIL[0m

| Mint | Held | Vault | Burned | dHeld | dVault | dBurned | |

|---|---|---|---|---|---|---|---|

| 1996 | 20.464916 | 3907.214028 | 16139.020590 | 73695.645149 | -171.987708 | 165.276973 | 29.088187 |

| 1997 | 20.407510 | 4461.748224 | 15553.598456 | 73746.998003 | 554.534196 | -585.422134 | 51.352855 |

| 1998 | 9.126091 | 4496.482451 | 15483.465970 | 73802.803772 | 34.734228 | -70.132486 | 55.805768 |

| 1999 | 1.355033 | 4197.025621 | 15782.904086 | 73811.948577 | -299.456830 | 299.438116 | 9.144805 |

| 2000 | 10.243511 | 3703.699982 | 16246.715137 | 73842.818198 | -493.325640 | 463.811051 | 30.869621 |

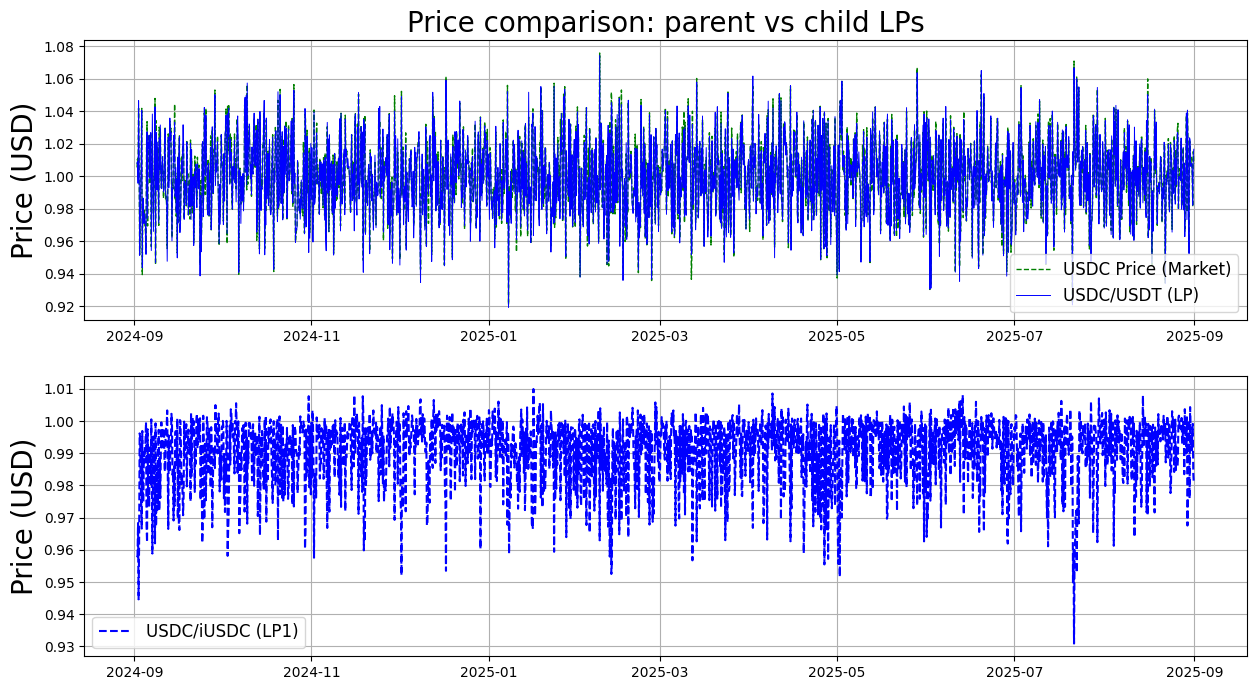

fig, (TKN_ax, DAI_ax) = plt.subplots(nrows=2, sharex=False, sharey=False, figsize=(15, 8))

strt_pt = 5

TKN_ax.plot(dates[strt_pt:], p_arr[strt_pt:], color = 'g',linestyle = 'dashed', linewidth=1, label=f'{tkn_nm} Price (Market)')

TKN_ax.plot(dates[strt_pt:], pTKN_DAI_arr[strt_pt:], color = 'b',linestyle = '-', linewidth=0.7, label=f'{tkn_nm}/{usd_nm} (LP)')

TKN_ax.set_title('Price comparison: parent vs child LPs', fontsize=20)

TKN_ax.set_ylabel('Price (USD)', size=20)

TKN_ax.legend(fontsize=12)

TKN_ax.grid()

DAI_ax.plot(dates[strt_pt:], pTKN_iTKN_arr[strt_pt:], color = 'b',linestyle = 'dashed', label=f'{tkn_nm}/{itkn_nm} (LP1)')

DAI_ax.set_ylabel('prices', size=20)

DAI_ax.set_ylabel('Price (USD)', size=20)

DAI_ax.legend(fontsize=12)

DAI_ax.grid()

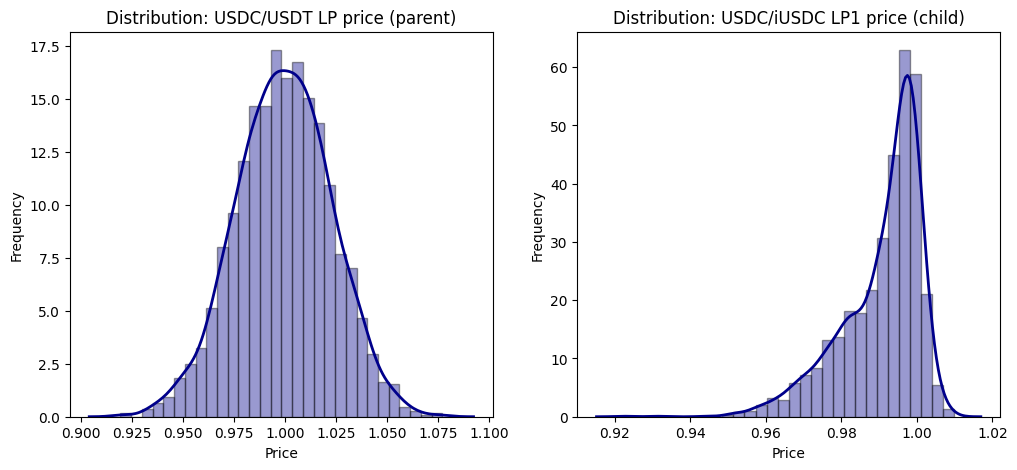

y1_samp = stats.gamma.rvs(a=2000, scale=0.0005, size=10000)

fig, ax = plt.subplots(1, 2, figsize=(12,5))

sns.distplot(pTKN_DAI_arr, hist=True, kde=True, bins=int(30), color = 'darkblue',

hist_kws={'edgecolor':'black'}, kde_kws={'linewidth': 2}, ax=ax[0])

sns.distplot(pTKN_iTKN_arr, hist=True, kde=True, bins=int(30), color = 'darkblue',

hist_kws={'edgecolor':'black'}, kde_kws={'linewidth': 2}, ax=ax[1])

ax[0].set_title(f'Distribution: {tkn_nm}/{usd_nm} LP price (parent)')

ax[0].set_xlabel('Price')

ax[0].set_ylabel('Frequency')

ax[1].set_title(f'Distribution: {tkn_nm}/{itkn_nm} LP1 price (child)')

ax[1].set_xlabel('Price')

ax[1].set_ylabel('Frequency')

Text(0, 0.5, 'Frequency')

lowess = sm.nonparametric.lowess

x = range(0,n_sim_runs)

res = lowess(lp_direct_invest_arr, x, frac=1/15); sm_lp_direct = res[:,1]

res = lowess(lp1_direct_invest_arr, x, frac=1/15); sm_lp1_direct = res[:,1]

res = lowess(lp1_tree_invest_arr, x, frac=1/15); sm_lp1_tree= res[:,1]

strt_ind = 3

fig, (p_ax) = plt.subplots(nrows=1, sharex=True, sharey=False, figsize=(15, 8))

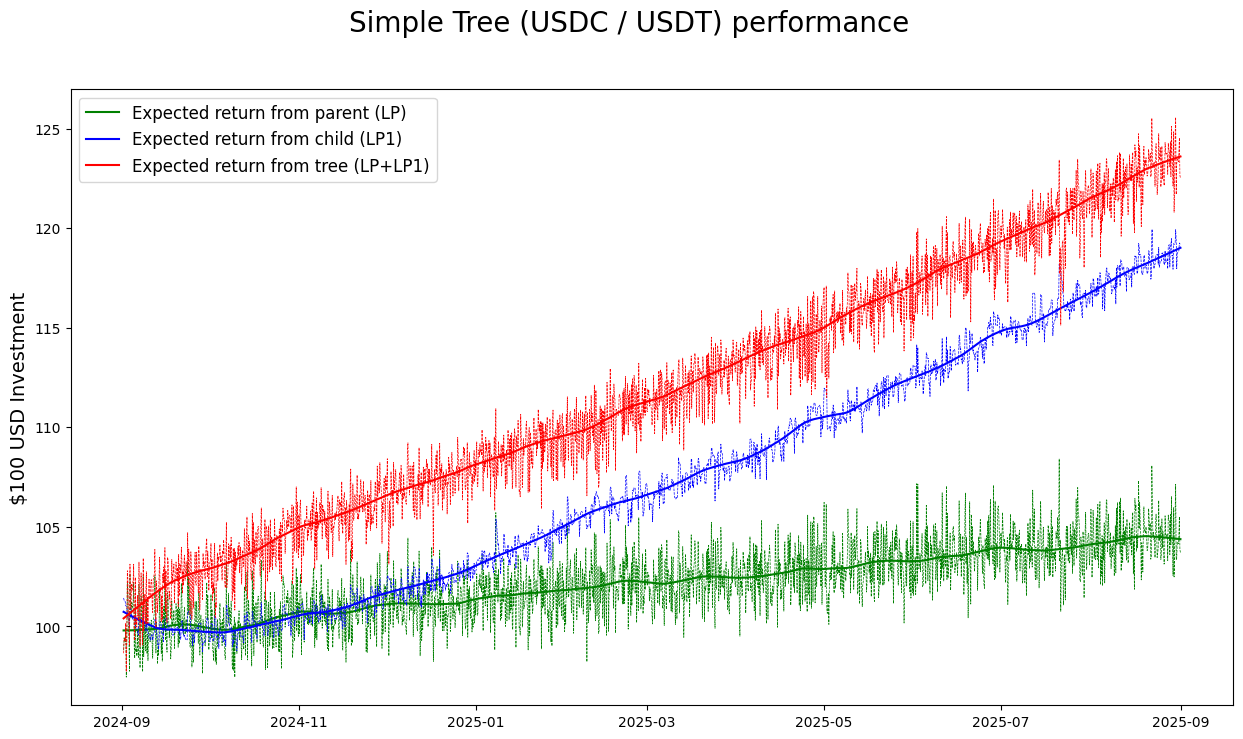

fig.suptitle('Simple Tree (USDC / USDT) performance ', fontsize=20)

p_ax.plot(dates[strt_ind:], lp_direct_invest_arr[strt_ind:], linestyle='dashed', linewidth=0.5, color = 'g')

p_ax.plot(dates[strt_ind:], sm_lp_direct[strt_ind:], color = 'g', label = 'Expected return from parent (LP)')

p_ax.plot(dates[strt_ind:], lp1_direct_invest_arr[strt_ind:], linestyle='dashed', linewidth=0.5, color = 'b')

p_ax.plot(dates[strt_ind:], sm_lp1_direct[strt_ind:], color = 'b', label = 'Expected return from child (LP1)')

p_ax.plot(dates[strt_ind:], lp1_tree_invest_arr[strt_ind:], linestyle='dashed', linewidth=0.5, color = 'r')

p_ax.plot(dates[strt_ind:], sm_lp1_tree[strt_ind:], color = 'r', label = 'Expected return from tree (LP+LP1)')

p_ax.legend( fontsize=12)

p_ax.set_ylabel("$100 USD Investment", fontsize=14)

Text(0, 0.5, '$100 USD Investment')

print(f'{tkn_invest:.3f} TKN before is worth {sm_lp_direct[-1]:.3f} TKN after direct investment into parent (lp)')

print(f'{tkn_invest:.3f} TKN before is worth {sm_lp1_direct[-1]:.3f} TKN after direct investment into child (lp1)')

print(f'{tkn_invest:.3f} TKN before is worth {sm_lp1_tree[-1]:.3f} TKN after investment into simple tree (lp + lp1)')

100.000 TKN before is worth 104.377 TKN after direct investment into parent (lp)

100.000 TKN before is worth 119.011 TKN after direct investment into child (lp1)

100.000 TKN before is worth 123.596 TKN after investment into simple tree (lp + lp1)

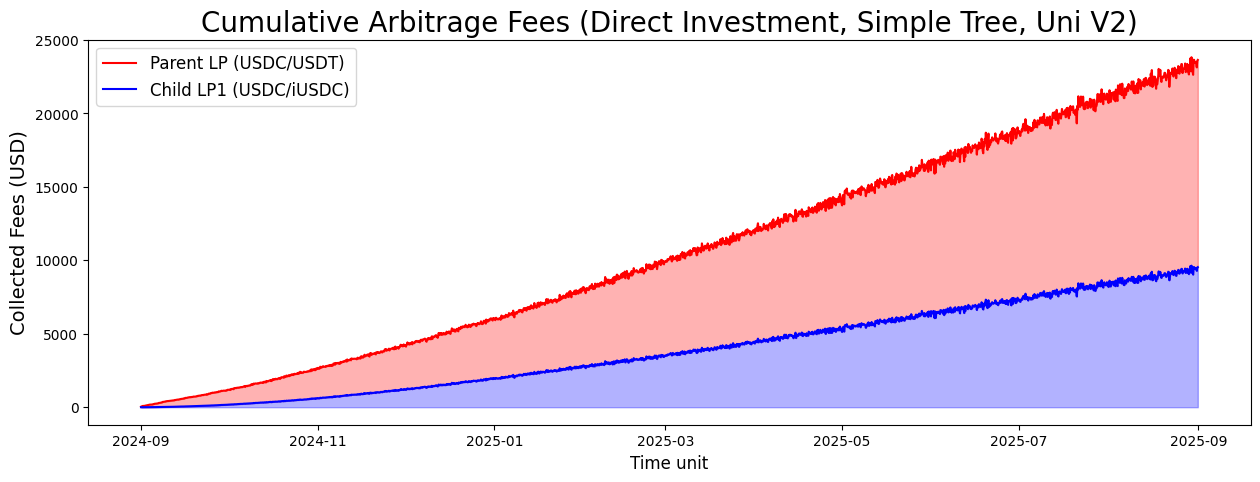

t = np.arange(0,len(fee_lp_arr))

fee_lpB = np.array(fee_lp1_arr)

fee_lpA = fee_lpB+np.array(fee_lp_arr)

fig = plt.figure(figsize=(15, 5))

plt.plot(dates, fee_lpA, color = 'r', label = f'Parent LP ({tkn_nm}/{usd_nm})')

plt.fill_between(dates, fee_lpB, fee_lpA, alpha=0.3, color='r')

plt.plot(dates, fee_lpB, color = 'b', label = f'Child LP1 ({tkn_nm}/{itkn_nm})')

plt.fill_between(dates, np.repeat(0,len(fee_lp_arr)), fee_lpB, alpha=0.3, color='b')

plt.title('Cumulative Arbitrage Fees (Direct Investment, Simple Tree, Uni V2)', fontsize = 20)

plt.xlabel("Time unit", fontsize=12)

plt.ylabel("Collected Fees (USD)", fontsize=14)

plt.legend(fontsize=12)

<matplotlib.legend.Legend at 0x16c0092d0>