Simple Uni V2 Tree - Infinite Index Token

- Assumptions:

- Uses Simple Tree

- Uses stablecoins (ie, USDC and USDT) to control for impermanent loss

- Infinite supply of index tokens

- LPs include:

- USDC-USDT

- USDC-iUSDC

- To run locally, download notebook from SYS-Labs repos

import os

import numpy as np

import pandas as pd

import datetime

import matplotlib.pyplot as plt

import scipy.stats as stats

import statsmodels.api as sm

import seaborn as sns

from uniswappy import *

Script params

init_tkn_lp = 100000

tkn_delta_param = 1000

tkn_invest_amt = 100

tkn_nm = 'USDC'

itkn_nm = 'iUSDC'

usdt_nm = 'USDT'

iusdt_nm = 'iUSDT'

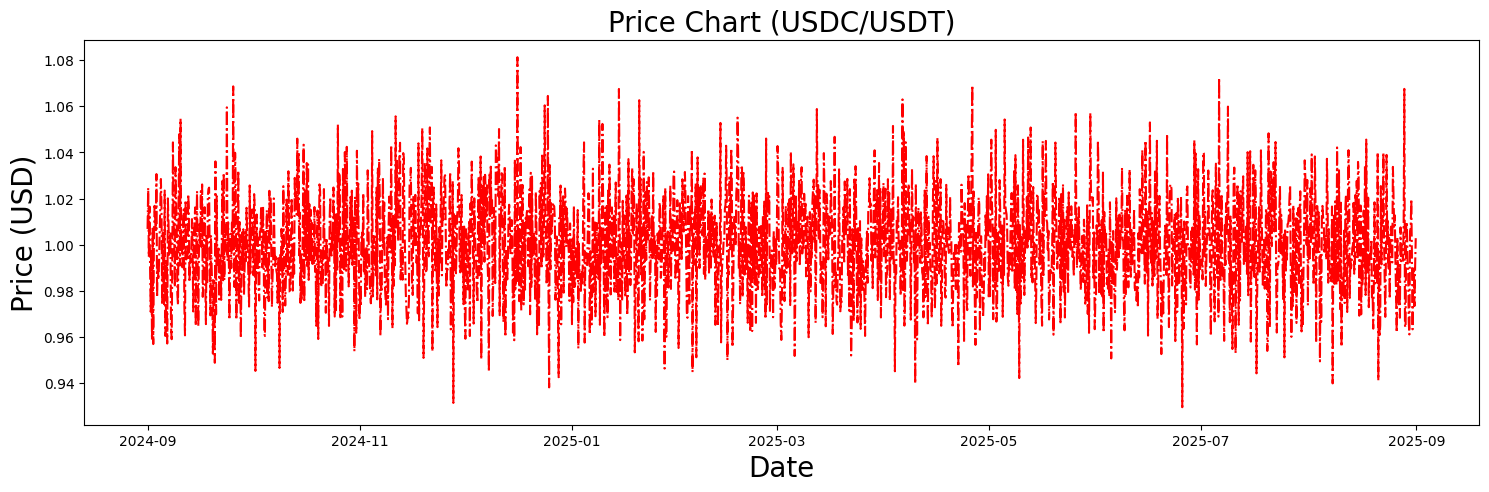

Simulate price data

# *************************

# *** Simulation

# *************************

n_sim_runs = 2000

seconds_year = 31536000

shape = 2000

scale = 0.0005

p_arr = np.random.gamma(shape = shape, scale = scale, size = n_sim_runs)

n_runs = len(p_arr)-1

dt = datetime.timedelta(seconds=seconds_year/n_sim_runs)

dates = [datetime.datetime.strptime("2024-09-01", '%Y-%m-%d') + k*dt for k in range(n_sim_runs)]

x_val = np.arange(0,len(p_arr))

fig, (USD_ax) = plt.subplots(nrows=1, sharex=False, sharey=False, figsize=(18, 5))

USD_ax.plot(dates, p_arr, color = 'r',linestyle = 'dashdot', label='initial invest')

USD_ax.set_title(f'Price Chart ({tkn_nm}/{usdt_nm})', fontsize=20)

USD_ax.set_ylabel('Price (USD)', size=20)

USD_ax.set_xlabel('Date', size=20)

Text(0.5, 0, 'Date')

Initialization Params

user_nm = 'user0'

tkn_amount = init_tkn_lp

usdt_amount = p_arr[0]*tkn_amount

Initialize Simple DEX Tree

usdt1 = ERC20(usdt_nm, "0x111")

tkn1 = ERC20(tkn_nm, "0x09")

exchg_data = UniswapExchangeData(tkn0 = tkn1, tkn1 = usdt1, symbol="LP", address="0x011")

TKN_amt = TokenDeltaModel(tkn_delta_param)

iVault1 = IndexVault('iVault1', "0x7")

factory = UniswapFactory(f"{tkn_nm} pool factory", "0x2")

lp = factory.deploy(exchg_data)

Join().apply(lp, user_nm, tkn_amount, usdt_amount)

tkn2 = ERC20(tkn_nm, "0x09")

itkn1 = IndexERC20(itkn_nm, "0x09", tkn1, lp)

exchg_data1 = UniswapExchangeData(tkn0 = tkn2, tkn1 = itkn1, symbol="LP1", address="0x012")

lp1 = factory.deploy(exchg_data1)

JoinTree().apply(lp1, user_nm, iVault1, 10000)

# Re-balance LP price after JoinTree

SwapDeposit().apply(lp, usdt1, user_nm, lp.reserve0-lp.reserve1)

lp.summary()

lp1.summary()

Exchange USDC-USDT (LP)

Reserves: USDC = 109999.99999999997, USDT = 110000.0

Liquidity: 109985.15703628703

Exchange USDC-iUSDC (LP1)

Reserves: USDC = 9972.071706380626, iUSDC = 4890.146199614032

Liquidity: 6983.186132220438

Take an investment position

tkn_invest = 100

invested_user_nm = 'invested_user'

SwapIndexMint(iVault1, opposing = False).apply(lp, tkn1, invested_user_nm, tkn_invest)

mint_itkn1_deposit = iVault1.index_tokens[itkn_nm]['last_lp_deposit']

SwapDeposit().apply(lp1, itkn1, invested_user_nm, mint_itkn1_deposit)

lp.summary()

lp1.summary()

lp_invest_track = lp.liquidity_providers[invested_user_nm]

lp1_invest_track = lp1.liquidity_providers[invested_user_nm]

# Redeem from parent

tkn_redeem_parent = RebaseIndexToken().apply(lp, tkn1, lp_invest_track)

# Redeem from tree (child + parent)

itkn_redeem_child = RebaseIndexToken().apply(lp1, itkn1, lp1_invest_track)

tkn_redeem_tree = RebaseIndexToken().apply(lp, tkn1, itkn_redeem_child)

print(f'{tkn_redeem_parent:.3f} USDC redeemed from {lp_invest_track:.3f} LP tokens if {tkn_invest:.1f} invested USDC immediately pulled from parent')

print(f'{tkn_redeem_tree:.3f} USDC redeemed from {lp1_invest_track:.3f} LP1 tokens if {tkn_invest:.1f} invested USDC immediately pulled from tree')

Exchange USDC-USDT (LP)

Reserves: USDC = 110099.99999999997, USDT = 110000.0

Liquidity: 110035.06384709699

Exchange USDC-iUSDC (LP1)

Reserves: USDC = 9972.071706380626, iUSDC = 4940.053010423988

Liquidity: 7018.676038131248

99.700 USDC redeemed from 49.907 LP tokens if 100.0 invested USDC immediately pulled from parent

99.403 USDC redeemed from 35.490 LP1 tokens if 100.0 invested USDC immediately pulled from tree

Simulate trading

arb = CorrectReserves(lp, x0 = 1)

arb1 = CorrectReserves(lp1, x0 = lp1.reserve1/lp1.reserve0)

TKN_amt = TokenDeltaModel(n_sim_runs)

lp_direct_invest_arr = []; lp1_direct_invest_arr = []; lp1_tree_invest_arr = [];

pTKN_USDT_arr = []; pTKN_iTKN_arr = []

fee_lp_arr = []; fee_lp1_arr = [];

for k in range(n_sim_runs):

# *****************************

# ***** Parent Arbitrage ******

# *****************************

arb.apply(p_arr[k])

# *****************************

# ***** Child Arbitrage ******

# *****************************

p_lp1 = SettlementLPToken().apply(lp, tkn1, lp1.reserve0)/lp1.reserve0

arb1.apply(p_lp1)

# *****************************

# ***** Random Swapping ******

# *****************************

Swap().apply(lp, tkn1, user_nm, TKN_amt.delta())

Swap().apply(lp, usdt1, user_nm, TKN_amt.delta())

# conservatively assume 10% of parent trading by volume

Swap().apply(lp1, tkn2, user_nm, 0.1*TKN_amt.delta())

Swap().apply(lp1, itkn1, user_nm, SettlementLPToken().apply(lp, tkn1, 0.2*TKN_amt.delta()))

# *****************************

# ******* Data Capture ********

# *****************************

# price

pTKN_USDT_arr.append(LPQuote().get_price(lp, tkn1))

pTKN_iTKN_arr.append(LPQuote().get_price(lp1, tkn1))

# investment performance

tkn_redeem_parent = RebaseIndexToken().apply(lp, tkn1, lp_invest_track)

itkn_redeem_child = RebaseIndexToken().apply(lp1, itkn1, lp1_invest_track)

tkn_redeem_tree = RebaseIndexToken().apply(lp, tkn1, itkn_redeem_child)

lp_direct_invest_arr.append(tkn_redeem_parent)

lp1_direct_invest_arr.append(RebaseIndexToken().apply(lp1, tkn2, lp1_invest_track))

lp1_tree_invest_arr.append(tkn_redeem_tree)

# DEX Fees

fee_lp_arr.append(TreeAmountQuote().get_tot_y(lp, lp.collected_fee0, lp.collected_fee1))

fee_lp1_arr.append(TreeAmountQuote().get_tot_y(lp1, lp1.collected_fee0, lp1.collected_fee1))

lp.summary()

lp1.summary()

# Redeem from parent

tkn_redeem_parent = RebaseIndexToken().apply(lp, tkn1, lp_invest_track)

# Redeem from tree (child + parent)

itkn_redeem_child = RebaseIndexToken().apply(lp1, itkn1, lp1_invest_track)

tkn_redeem_tree = RebaseIndexToken().apply(lp, tkn1, itkn_redeem_child)

print(f'{tkn_redeem_parent:.3f} USDC redeemed from {lp_invest_track:.3f} LP tokens if {tkn_invest:.1f} invested USDC pulled from parent (lp)')

print(f'{tkn_redeem_tree:.3f} USDC redeemed from {lp1_invest_track:.3f} LP1 tokens if {tkn_invest:.1f} invested USDC pulled from tree (lp + lp1)')

Exchange USDC-USDT (LP)

Reserves: USDC = 147136.0106536532, USDT = 146900.94926218514

Liquidity: 138640.7591830568

Exchange USDC-iUSDC (LP1)

Reserves: USDC = 12858.805522377965, iUSDC = 6120.031452710504

Liquidity: 8295.338161424965

105.752 USDC redeemed from 49.907 LP tokens if 100.0 invested USDC pulled from parent (lp)

110.561 USDC redeemed from 35.490 LP1 tokens if 100.0 invested USDC pulled from tree (lp + lp1)

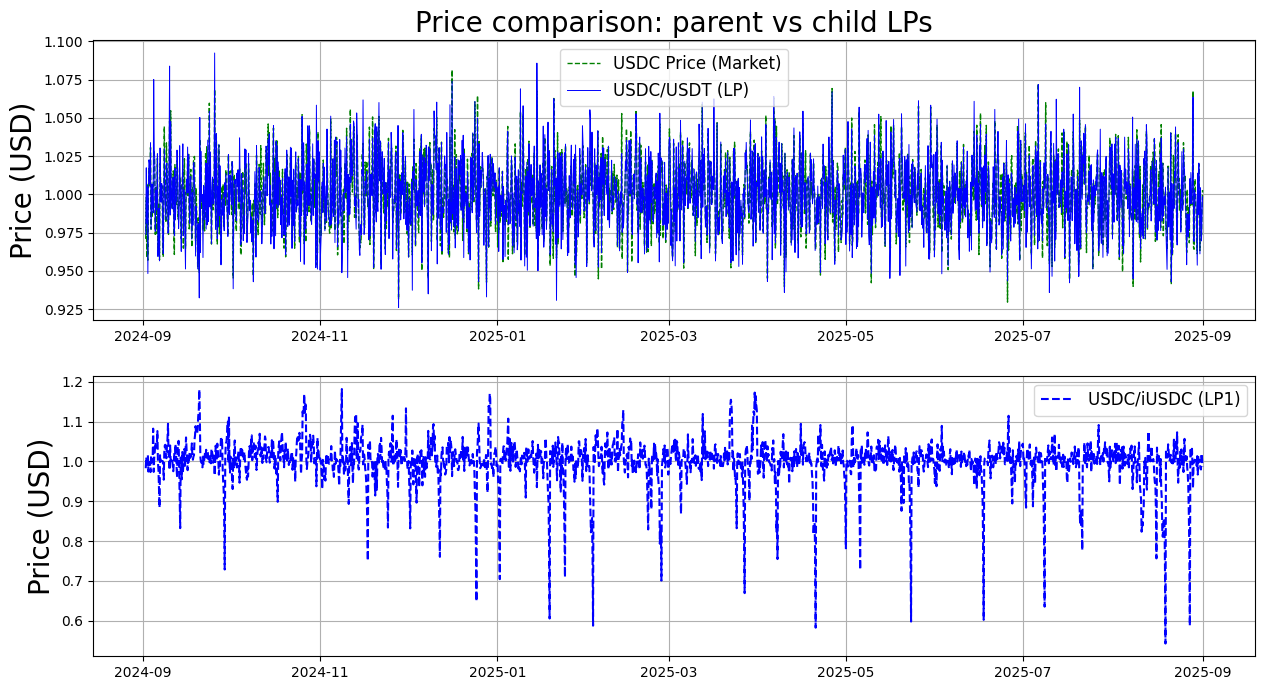

fig, (TKN_ax, USDT_ax) = plt.subplots(nrows=2, sharex=False, sharey=False, figsize=(15, 8))

strt_pt = 5

TKN_ax.plot(dates[strt_pt:], p_arr[strt_pt:], color = 'g',linestyle = 'dashed', linewidth=1, label=f'{tkn_nm} Price (Market)')

TKN_ax.plot(dates[strt_pt:], pTKN_USDT_arr[strt_pt:], color = 'b',linestyle = '-', linewidth=0.7, label=f'{tkn_nm}/{usdt_nm} (LP)')

TKN_ax.set_title('Price comparison: parent vs child LPs', fontsize=20)

TKN_ax.set_ylabel('Price (USD)', size=20)

TKN_ax.legend(fontsize=12)

TKN_ax.grid()

USDT_ax.plot(dates[strt_pt:], pTKN_iTKN_arr[strt_pt:], color = 'b',linestyle = 'dashed', label=f'{tkn_nm}/{itkn_nm} (LP1)')

USDT_ax.set_ylabel('prices', size=20)

USDT_ax.set_ylabel('Price (USD)', size=20)

USDT_ax.legend(fontsize=12)

USDT_ax.grid()

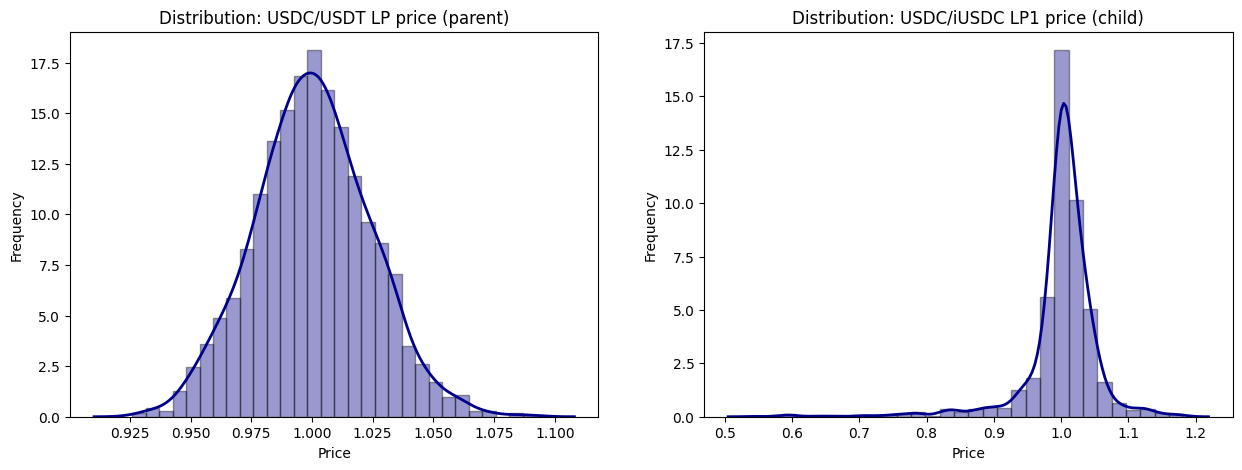

fig, ax = plt.subplots(1, 2, figsize=(15,5))

sns.distplot(pTKN_USDT_arr, hist=True, kde=True, bins=int(30), color = 'darkblue',

hist_kws={'edgecolor':'black'}, kde_kws={'linewidth': 2}, ax=ax[0])

sns.distplot(pTKN_iTKN_arr, hist=True, kde=True, bins=int(30), color = 'darkblue',

hist_kws={'edgecolor':'black'}, kde_kws={'linewidth': 2}, ax=ax[1])

ax[0].set_title(f'Distribution: {tkn_nm}/{usdt_nm} LP price (parent)')

ax[0].set_xlabel('Price')

ax[0].set_ylabel('Frequency')

ax[1].set_title(f'Distribution: {tkn_nm}/{itkn_nm} LP1 price (child)')

ax[1].set_xlabel('Price')

ax[1].set_ylabel('Frequency')

Text(0, 0.5, 'Frequency')

lowess = sm.nonparametric.lowess

x = range(0,n_sim_runs)

res = lowess(lp_direct_invest_arr, x, frac=1/15); sm_lp_direct = res[:,1]

res = lowess(lp1_direct_invest_arr, x, frac=1/15); sm_lp1_direct = res[:,1]

res = lowess(lp1_tree_invest_arr, x, frac=1/15); sm_lp1_tree= res[:,1]

strt_ind = 3

fig, (p_ax) = plt.subplots(nrows=1, sharex=True, sharey=False, figsize=(15, 8))

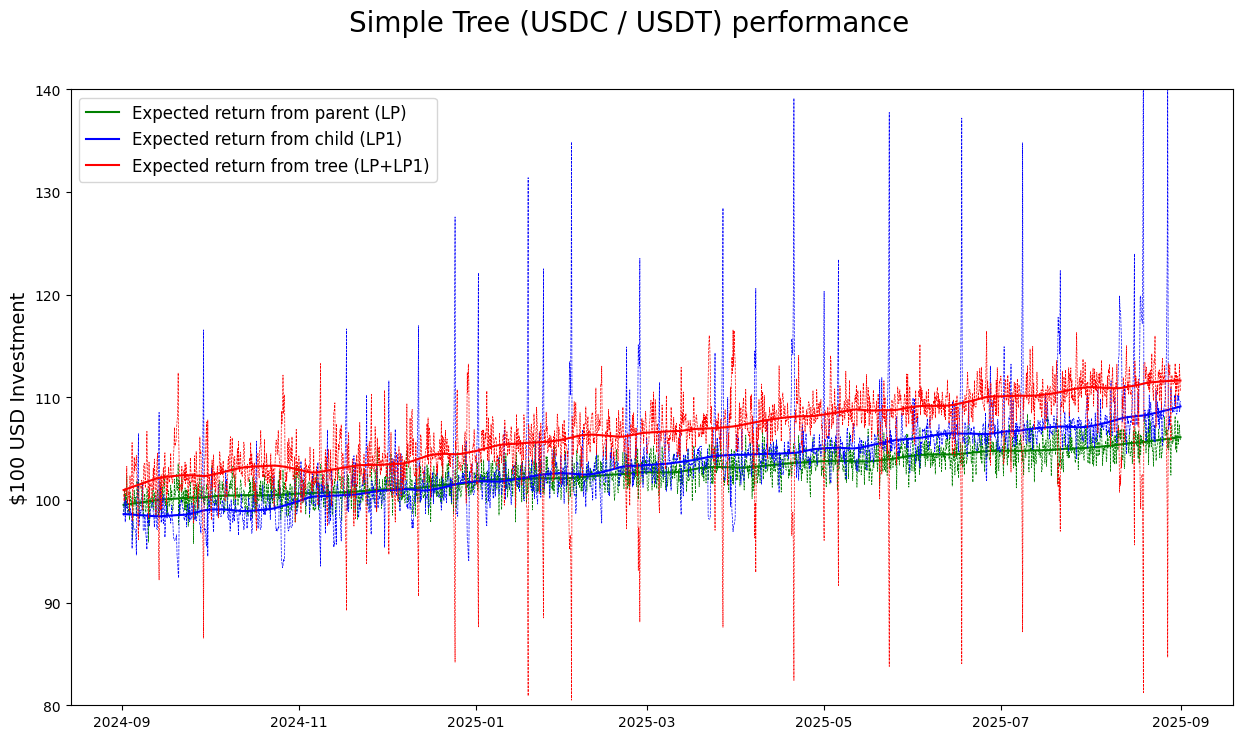

fig.suptitle('Simple Tree (USDC / USDT) performance ', fontsize=20)

p_ax.plot(dates[strt_ind:], lp_direct_invest_arr[strt_ind:], linestyle='dashed', linewidth=0.5, color = 'g')

p_ax.plot(dates[strt_ind:], sm_lp_direct[strt_ind:], color = 'g', label = 'Expected return from parent (LP)')

p_ax.plot(dates[strt_ind:], lp1_direct_invest_arr[strt_ind:], linestyle='dashed', linewidth=0.5, color = 'b')

p_ax.plot(dates[strt_ind:], sm_lp1_direct[strt_ind:], color = 'b', label = 'Expected return from child (LP1)')

p_ax.plot(dates[strt_ind:], lp1_tree_invest_arr[strt_ind:], linestyle='dashed', linewidth=0.5, color = 'r')

p_ax.plot(dates[strt_ind:], sm_lp1_tree[strt_ind:], color = 'r', label = 'Expected return from tree (LP+LP1)')

p_ax.legend( fontsize=12)

p_ax.set_ylim(80, 140)

p_ax.set_ylabel("$100 USD Investment", fontsize=14)

Text(0, 0.5, '$100 USD Investment')

print(f'{tkn_invest:.3f} TKN before is worth {sm_lp_direct[-1]:.3f} TKN after direct investment into parent (lp)')

print(f'{tkn_invest:.3f} TKN before is worth {sm_lp1_direct[-1]:.3f} TKN after direct investment into child (lp1)')

print(f'{tkn_invest:.3f} TKN before is worth {sm_lp1_tree[-1]:.3f} TKN after investment into simple tree (lp + lp1)')

100.000 TKN before is worth 106.113 TKN after direct investment into parent (lp)

100.000 TKN before is worth 109.111 TKN after direct investment into child (lp1)

100.000 TKN before is worth 111.629 TKN after investment into simple tree (lp + lp1)

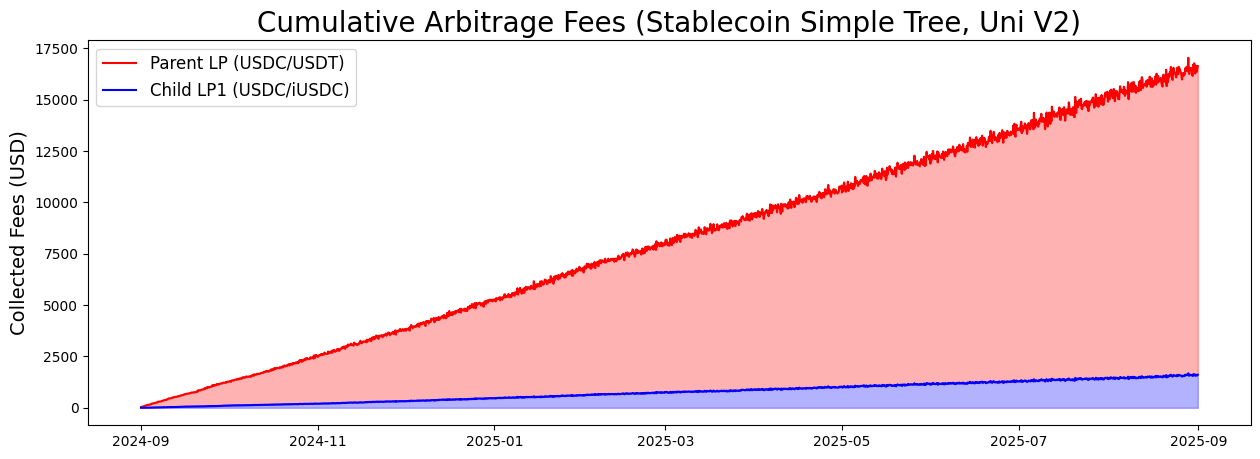

t = np.arange(0,len(fee_lp_arr))

fee_lpB = np.array(fee_lp1_arr)

fee_lpA = fee_lpB+np.array(fee_lp_arr)

fig = plt.figure(figsize=(15, 5))

plt.plot(dates, fee_lpA, color = 'r', label = f'Parent LP ({tkn_nm}/{usdt_nm})')

plt.fill_between(dates, fee_lpB, fee_lpA, alpha=0.3, color='r')

plt.plot(dates, fee_lpB, color = 'b', label = f'Child LP1 ({tkn_nm}/{itkn_nm})')

plt.fill_between(dates, np.repeat(0,len(fee_lp_arr)), fee_lpB, alpha=0.3, color='b')

plt.title('Cumulative Arbitrage Fees (Stablecoin Simple Tree, Uni V2)', fontsize = 20)

plt.ylabel("Collected Fees (USD)", fontsize=14)

plt.legend(fontsize=12)

<matplotlib.legend.Legend at 0x282f48eb0>